Tariff - This is the initial wage of a certain type, nature, qualification.

Tariff system - this is a set of various legal acts adopted in a centralized manner, ensuring the differentiation of wages depending on the complexity of the work performed, working conditions, etc.

Elements:

1. Tariff and qualification reference books of works and professions of workers and qualification reference books of employees;

2. Tariff grids;

3. Tariff rates;

4. Allowances and various additional payments for work with deviations from normal working conditions;

5. District coefficients.

Tariff and qualification reference book of works and professions

Allows you to be guided by uniform criteria in determining the complexity of the work performed and assigning it the appropriate category.

Tariff grid - this is a certain scale, divided into categories, which allows you to determine the size of the tariff rate for the remuneration of workers and their qualifications by multiplying the tariff rate of the 1st category by the tariff coefficient.

Tariff rate - This is the wages of an employee for a certain unit of time (hour, day or month). The higher the rank of the employee, the higher his rate. In each tariff scale, the rate of 1 category is given. The rates of other categories are determined by multiplying it by the tariff coefficient of the corresponding category cat. shows how many times the payment rate for this category is higher than the first.

District coefficient. The main goal is to compensate for the higher cost of living and to equalize the salary of this area with another. The regional coefficient is calculated from the first day of work in the given region.

Payroll methods in various forms and systems

The principles of payroll are different. They depend on the chosen system of remuneration:

Time-based (tariff), when actual hours worked are paid;

Piecework - depending on the number of products manufactured by the employee;

Tariff-free, that is, in accordance with the labor contribution of the employee to the activities of the company;

According to the system of floating salaries, when the amount of payment depends on the amount of money that the company can send to wages;

On a commission basis, when salaries are paid as a percentage of revenue.

Time payment

Time wages are of two types:

Simple;

Time premium.

Simple time.

Under a simple time-based system, workers are paid for the time they actually work.

Time premium.

In the time-bonus system, along with the salary, the employee is credited with a bonus. It is set as a fixed amount or as a percentage of salary. In this case, the salary is calculated in the same way as with a simple time-based system. And the bonus is added to the salary and paid along with it.

Piece-work payment

Under the piecework system, the employee is paid for the amount of products (works, services) that he has produced. To do this, use the piece rates established by the company.

There are several types of piecework wages:

Simple;

piece-premium;

piece-progressive;

Indirect piecework;

Chord.

piece rate

The output rate is the amount of products (works, services) that an employee must produce per unit of working time (for example, 10 products per hour).

Piecework premium.

In the piece-bonus system, the employee receives bonuses in addition to wages.

Piece-progressive.

Under this system, piece rates depend on the quantity of products produced for a given period of time (for example, a month). As output increases, so does the piece rate.

Indirectly piecework.

The indirect piecework system is used, as a rule, to pay employees of service and auxiliary industries.

In this case, earnings depend on the wages of workers in the main production who receive piecework.

Chord.

The chord system is used to pay the brigade. A team consisting of several people is given a task that must be completed within a certain period of time. For this, the team is paid a reward. Its amount is divided among the workers of the brigade, depending on how much time each of them worked.

Other forms of payment

Depending on the specifics of the activities of a particular company, it may apply other systems of remuneration.

These include, in particular:

Tariff-free payment;

floating salary system;

Compensation on a commission basis.

Tariff-free

This system can be used only by firms in which there are few employees and they are all in sight. Then it is easy to take into account the usefulness for the common cause of each person.

floating salary system

Under such a system, the earnings of workers depend on the results of their work, the profits of the company and the amount that can be directed to wages.

Payment on a commission basis

When paying commissions, wages are set as a percentage of the revenue that the firm receives as a result of the activities of a particular employee. This system is usually used for those who sell products (goods, works, services).

SUPPLEMENTS

If the working conditions in which the employee works deviate from normal, it is necessary to accrue an additional payment to his basic salary.

Additional payments are charged for the work:

Overtime;

At night time;

In the evening and at night with multi-shift operation;

On holidays and weekends;

When combining professions or replacing temporarily absent employees.

Prizes

A bonus is an additional payment of a stimulating or incentive nature to the basic salary of an employee.

General payment procedure.

Rewards can be of two types:

1. Incentive bonuses, which are provided for by the wage system.

2. Bonuses (encouragement) for distinguished employees outside of wage systems.

3. Payment for inactivity (holidays, downtime, forced absenteeism)

Downtime payment

Payment for downtime - the time when the employee was at work, but did not participate in the production process - depends on their cause.

Payroll is an issue that in any business entity can only compete with issues such as pricing or sales assurance in terms of severity.

The experience of the majority of business entities in the economic conditions of the market has proved that without strong personal incentives it is impossible to solve the problems of production development. One of the key incentives is payroll.

Any person in the enterprise: the owner, manager or worker - must know how to calculate wages.

Salary implements a lot of functions, which include:

- a reproductive function, consisting in the fact that the salary provides the worker and his family with the volume of consumption of material goods necessary for the expanded reproduction of the labor force;

- stimulating function, consisting in the fact that payroll contributes to the motivation of employees for labor activity and the formation of material interest in fruitful work;

- distribution function, which consists in the fact that wages are a measure of the cost of living labor for the distribution of means of consumption among the employees of an economic entity;

- the regulatory function is manifested in the impact of earnings on the situation in the labor market, including the number of employees and the level of employment;

- resource function, which consists in the fact that earnings are an effective factor in the best distribution of labor resources among business entities in various fields and industries;

- the social function is due to the fact that the salary provides the working population with sufficient conditions and living standards;

- status function, which consists in the correspondence of the status of the worker, determined by the size of the salary, to his labor status.

Any of these functions is part of the whole system, and not only implies the presence of other parts, but also contains their characteristics. In particular, the reproductive function only emphasizes the social significance of wages.

Traditional forms of wages

Payroll options are built on the basis of combinations of two basic forms - time and piecework. These forms differ in the way it is calculated.

Payroll options are built on the basis of combinations of two basic forms - time and piecework. These forms differ in the way it is calculated.

So, for example, the time-based form of earnings implies that its value is set based on the hours worked, while piecework wages are accrued to the worker, based on the amount of output. At all stages of industrial development, the first, then the second form prevailed.

The procedure for calculating wages takes into account many factors, including the form of ownership of resources, the size and production structure of a business entity, the nature of manufactured products, and, in addition, the specifics of the values prevailing in the team.

Time wages are earnings that depend on the time worked, taking into account the professional affiliation and skill level of the employee.

The amount of wages under a simple time-based system is determined by the use of a tariff system, which includes the following elements:

- tariff rates;

- tariff scale;

- tariff-qualification reference book.

Tariff rates are the amount of earnings of various categories of working enterprises for a given unit of time. The primary rate is the first category, that is, the minimum tariff rate. The rate of the first category determines the level of wages that must be accrued to the employee for the most simple work.

The hourly wage rate of the first category in normal production conditions is determined by the ratio of the minimum wage, determined by Russian law, to the monthly working time fund.

The hourly wage rate of the first category in normal production conditions is determined by the ratio of the minimum wage, determined by Russian law, to the monthly working time fund.

The next component of the tariff system is the tariff scale, in the form of tariff coefficients, which displays the ratio of rates of certain categories to the rate of the first category. The tariff coefficient of the first category is equal to 1. The coefficients of all other categories represent how many times the tariff rates of the granted categories exceed the rate of the first category.

The value of the tariff scale is determined by the fact that it can be used to easily calculate the rate of any category.

Tariff scales are intended to ensure the differentiation of earnings and create a clear dependence of the earnings received on the qualifications of the worker. This guarantees the implementation of the principles of differentiation and fairness in remuneration.

Wage categories and coefficients for employees are assigned in accordance with the third element of the tariff system, called the tariff-qualification directory. The named reference book has the form of a list of professions and specialties of working enterprises, which contains the necessary qualification requirements in relation to the formed knowledge and skills for workers performing work that is diverse in content and level of complexity, and, in addition, taking into account the nature of the responsibility of workers for the quality of work performed.

Grouping rates

The size of tariff rates for industries is set at different levels, since their significance is taken into account, as well as the complexity, intensity and working conditions for various categories of workers. The tariff rates of economic entities are also differentiated in a clear dependence on the forms of earnings, working conditions, as well as the role of the work performed.

The size of tariff rates for industries is set at different levels, since their significance is taken into account, as well as the complexity, intensity and working conditions for various categories of workers. The tariff rates of economic entities are also differentiated in a clear dependence on the forms of earnings, working conditions, as well as the role of the work performed.

In most industries, 3 groups of rates are usually used for employees:

- For normal working conditions.

- For heavy work. In this case, the rates are set at 10-15% more than the rates applied under normal conditions.

- For especially heavy, including harmful to health, works. In this case, the rates are set at 20-30% more than the rates applied under normal conditions.

Such differentiation not only makes it possible to eliminate injustice in wages in conditions other than normal, but also to attract workers to this type of work.

Tariff rates depend on the selected unit of time. Most industries use hourly rates.

Tariff rates depend on the selected unit of time. Most industries use hourly rates.

Time wages ultimately allow the formation of two systems:

- simple hourly wages;

- time bonus salary.

With a simple time-based system, the qualifications of the employee and the time worked by him are taken into account.

With a time-based bonus system, an employee is also paid a bonus for achieving the intended results.

For a worker, a time wage is a certain guarantee of a relatively stable income. But there is a problem - in fact, a person earns money solely for his presence in the workplace, but he has no motive for fruitful work.

Piecework wages are a form of income that depends on the quantity of the appropriate quality of the products produced. A similar form of salary is used if it is possible to set such quantitative output targets that employees can achieve and increase in order to increase earnings.

With a piecework form of payment, earnings are accrued depending on the volume of production and piecework rates.

With a piecework form of payment, earnings are accrued depending on the volume of production and piecework rates.

The rate is the established amount of wages charged to a worker for a physical unit of finished products.

The piecework form of earnings, at first glance, is in the best interests of both the employee and his employer. This is explained by the fact that the amount of earnings depends on the results of the work of the worker in a direct way. However, piecework does have its drawbacks.

So, for example, it can be difficult for an employer to take into account production factors that affect the production of a worker, but do not depend on him. In addition, a serious drawback of the piecework form is the threat that workers, in pursuit of an increase in the number of products, will no longer pay due attention to the level of its quality.

Fundamental systems of piecework wages

Piecework wages are divided into the following fundamental systems: simple piecework wages, in which wages are calculated and paid on the basis of a piecework rate only taking into account the quantity of products produced:

- Piece-bonus wages, in which the employee receives both a part of earnings calculated at piece rates and a bonus in a fixed percentage for achieving target production indicators.

- Indirect piecework wages are used exclusively to pay for the labor of one of the categories of workers at the enterprise - auxiliary workers who do not directly create products, but provide the conditions necessary for the work of the main pieceworkers. These workers can receive wages at indirect piece rates, taken for a unit of finished products produced by piecework workers.

- The piece-progressive salary in its structure includes 2 parts. One part is determined by simple piece rates for volume indicators within certain norms, that is, as simple piecework wages, and the other - by increased rates is determined taking into account the degree of fulfillment of production standards.

- The piece-rate salary provides for the approval of the amount of salary for the implementation of the approved scope of work with the appointment of a deadline for their implementation. Even if the work is completely completed before a certain period, the amount of salary is paid in full. Such a system is usually implemented when there is a need to quickly perform a significant and rather complex amount of work.

Application of allowances and additional payments to wages

Wages in the current market conditions cannot be considered solely as a reward for work.

Modern payroll systems are required not only to take into account the production results achieved by employees, but also to form their material interest in improving the results and efficiency of activities.

Actually, for this purpose, a certain system of additional payments, that is, allowances and surcharges, is being formed.

Actually, for this purpose, a certain system of additional payments, that is, allowances and surcharges, is being formed.

The production and social parameters of labor, which do not depend on the employee, actually take into account compensation payments. Such payments are permanent. The payroll data group covers a wide range of payments, including allowances and surcharges for night work, weekends or holidays, multi-shift work, and others.

The amount of compensation payments is approved by law and is mandatory for use.

Incentive bonuses and additional payments reflect the results of the employee's activities and are needed to motivate them to achieve the established result. This group of accruals includes payments according to the bonus system approved by the enterprise, remuneration for long service (length of service), combination of positions, professional skills and others.

Incentive surcharges and allowances are determined and charged autonomously by a business entity.

Unlike compensation, such payments are variable and are not mandatory for the enterprise.

The organization of wages in any business entity means the construction of an effective system for accruing and paying wages, capable of making the amount of earnings in clear dependence on the work of each employee, thereby raising its motivating function.

Perhaps the most important issue that worries both the employee and the employer is payroll. If the employer makes a mistake somewhere and underpays the employee, he may have serious problems with the labor commission and the tax service, and if the employee does not know what his salary consists of and the procedure for paying it, he may never know what he underpay.

Normative base

Features of the calculation and payment of wages are described in Art. 21 of the Labor Code of the Russian Federation. In Art. 136 of the Labor Code "Procedure, place and terms of payment of wages" describes the main nuances that an employer needs to know when calculating and paying wages.

How salary is calculated

The salary of each employee is calculated in accordance with the procedure established by the enterprise, with which the employee must be familiarized. When calculating salaries, the system of remuneration that is established at the enterprise for this category of employee, all incentives and penalties, all social and other payments and tax deductions are taken into account. According to the legislation, the employer pays pension and insurance contributions from his own funds.

Information required for billing

Payroll is calculated from the first day when the employee begins to perform his duties.

After the employee brings all the documents necessary for applying for a job to the personnel department (or directly to the employer, if we are talking about a small enterprise), he signs an employment contract with the employer.

The employment contract stipulates all the nuances of labor relations - from the mode of operation and payment of wages to the specifics of termination of the employment contract. On the basis of this agreement, an order or order is issued for the enterprise to hire a new employee, and it is this document that is the basis for the accounting department (or settlement department) for calculating wages.

In addition to the order or instruction on hiring, which contains information about the start date of work, the salary of the employee and his last name, first name, patronymic, position, personnel number, the payroll accountant also needs the following information:

- the established system of remuneration - time-based, piecework or mixed;

- actual hours worked or information on the volume of products produced (services rendered).

For laid-off employees, you will also need the date of termination of employment and information about unused vacation days.

Pay systems

In order to know how to calculate wages, you need to know which wage system is established for the employee. There are two main systems:

- time-based - when an employee is paid a salary depending on the hours worked, days, weeks, and so on. Accounting is kept in a worksheet - electronic or paper;

- piecework - when wages are paid, for example, for the number of units of production or services rendered. Accounting is carried out according to the forms developed and installed at the enterprise.

Payment procedure

According to labor law, wages must be paid twice a month. The employer can set the dates of payments on his own and must necessarily register in the local documents of the enterprise, for example, in a collective agreement.

Also, the employer must establish whether payments are made in cash or transferred to the employee’s bank account and approve the form of the document (pay slip), which will describe the calculation of wages, accrued bonuses, deductions made, and the like.

Also, the employer must establish whether payments are made in cash or transferred to the employee’s bank account and approve the form of the document (pay slip), which will describe the calculation of wages, accrued bonuses, deductions made, and the like.

According to the Labor Code, the employer is obliged to familiarize the employee both with the procedure for calculating wages and with all the details of its calculation.

Usually the first payment at the beginning of the month is called an advance payment. It is calculated using one of two methods:

- establish a certain percentage of the employee's salary - for example, thirty or forty - excluding bonuses, allowances, deductions, and the like;

- calculate the salary due to the employee for the time actually worked or for the number of units of goods (services) produced, taking into account bonuses, allowances and deductions.

Of course, it is more convenient to calculate and pay a fixed amount. Payments must be made strictly on the set date; if it falls on a weekend or holiday, payment must be made the day before. Accounting for payments must be kept according to the statement, the form of which was established by the State Statistics Committee on 05.01.2004.

Additional accruals and deductions

Before the salary is paid, all payments and deductions due to the employee must be made. Holds are as follows:

- payment of income tax - a mandatory state tax on the income of individuals, the list of which includes wages;

- deductions for material damage caused by the employee;

- deductions for overspent vacation days (for laid-off workers);

- alimony;

- payments to repay the loan - at the written request of the employee;

- deductions, if there was an overpaid salary.

Additional payments are as follows:

- the mandatory or additional bonus established at the enterprise based on the results of work in the billing period;

- coefficient established in the region;

- established allowance for working conditions;

- holiday payments.

Let's look at some deductions and additional payments in more detail.

Income tax

According to the law, before paying salaries, it is necessary to withhold personal income tax from it. The interest rate for a resident of the country - a person who has spent the last one hundred and eighty-three days in the territory of the state - is thirteen percent. Income tax is calculated before withholding alimony, money to pay off a loan, and the like.

Vacation pay

Holiday pay (as well as deduction) is made according to the average daily earnings. If the employee has worked the billing period (year) in full, then the average daily earnings are equal to the wages paid for this period, divided by twelve months and the average monthly number of calendar days - this value is considered to be 29.4.

If the employee has not fully worked the billing year, then the number of months that he has worked in full is multiplied by the average monthly number of calendar days and the calendar number of days in the incompletely worked month is added. The resulting number is divided by the salary paid by the employee for the period worked by him. The average daily earnings are multiplied by the number of vacation days and the employee is paid the amount received.

Vacation money must be paid to the employee three days before he goes on vacation, so it is better to calculate vacation pay without waiting for the end of the month. An order to grant leave to an employee must be issued and endorsed two weeks before it begins.

Calculation of sick pay

The payment of sick leave benefits is also made according to the average daily earnings, but it is calculated by dividing the average earnings (for the last two years) by seven hundred and thirty - the number of days worked. When paying benefits, the insurance percentage is also taken into account, which is set depending on the insurance period:

- less than five years - sixty percent;

- from five to eight years - eighty percent;

- eight or more years - one hundred percent.

The average daily earnings are multiplied by the number of days on the sick leave, the amount received is multiplied by the insurance percentage and the resulting number is paid to the employee.

The payment of sick leave benefits is possible only when the sick leave is closed and provided by the employee to the accounting department or the settlement department of the enterprise. Most often, an employee receives sick pay with the next salary.

Maternity benefits are always multiplied by one hundred percent, regardless of the insurance period. Also, the average daily earnings are calculated a little differently: the average earnings must be divided by the number of days in the last two years worked, with the exception of those days when the employee was on sick leave, on maternity leave and childcare.

Maternity benefits are always multiplied by one hundred percent, regardless of the insurance period. Also, the average daily earnings are calculated a little differently: the average earnings must be divided by the number of days in the last two years worked, with the exception of those days when the employee was on sick leave, on maternity leave and childcare.

Since there are a lot of nuances in the payment of wages, the example of payroll in each case will be different.

Cases of miscalculation

This is not to say that cases where wages are calculated incorrectly are frequent and ubiquitous, but sometimes they happen. Salary can be incorrectly calculated for various reasons, for example, in the event of a mechanical error of an accountant who calculates the wrong amount or figure.

"Extra" money is considered unjust enrichment and must be returned - that is, they will be deducted from the next salary. At the same time, there are such nuances: the total amount of all deductions should not exceed twenty percent of the salary established for the employee. That is, if the employee, for example, still pays alimony, the amount of this payment and deductions for the return of incorrectly accrued wages cannot exceed the twenty percent mentioned above; if the excess salary was paid as a result of the employee’s dishonest behavior or the accounting error of the accountant, it is withheld from the employee, but if the salary was overstated due to the accountant’s negligence, the costs will be deducted from the accountant, since the loss was caused to the enterprise through his fault.

How to calculate the standard salary for an employee who wants to independently double-check the calculation in the accounting department? When a person is hired, a salary is negotiated. in addition to it, when calculating salaries, coefficients are taken into account, as well as the number of days worked by him and other factors that can somehow affect its final size. They are what we are talking about.

What you need to know in order to accurately and correctly calculate the salary?

When applying for a job, an applicant for a job must negotiate with his employer the amount of wages. And if an employee hears the size of the amount, he does not always think that in fact the payment will be different. The amount of money that is negotiated at the time of employment is salary (a fixed amount of wages). And it will show up in the contract. But how much an employee will actually receive depends on a host of other factors.

| What you should pay attention to | Income taxes are deducted from the employee's funds, and the employer makes the insurance premium from other funds. An employee can receive an advance. The employee may also have obligations to pay child support or other monetary payments. Allowances and coefficients can be applied to the salary of an employee of an enterprise, bonuses and other additional payments can be accrued to him. |

| What is the calculation formula | The simplest formula includes 3 points:

|

If an employee of the enterprise does not have to make payments (for example, alimony) and they do not make additional payments, then the salary is calculated as follows:

Tax is deducted from the amount received (in the Russian Federation, personal income tax is 13%)

Consider one example

The employee's salary is 30 thousand rubles. In his worked month, he had 23 working days in a month. The employee took 3 days without saving his wages, therefore - he worked 20 days this month. The payroll then looks like this:

30,000 should be divided by 23 and multiplied by 20 = 26,086 rubles. (salary before personal income tax);

26,086 minus 13% = 22,695 rubles. (salary paid out).

However, in practice, such simple calculations practically do not happen. Employees are often paid bonuses, as well as various allowances and compensations. Let's assume that an employee receives a monthly bonus of 25% of the salary in addition to the usual salary of 30 thousand rubles. And he worked 20 days instead of 23 in a month. Then his calculation will look like:

Salary plus bonus (30,000 plus 7,500) = 37,500 rubles. (wage);

37,500 divided by 23 and multiplied by 20 = 32,608 rubles. (salary without personal income tax);

32,608 minus 13% = 28,369 rubles. (salary handed out).

In cases where an employee of an enterprise has the right to receive a tax deduction, the tax is calculated in advance, and after that it is deducted from his salary. For example, if the salary is 30 thousand rubles and the employee worked all the days, then he has the right to deduct 800 rubles. Then the calculation will be like this:

30,000 minus 800 \u003d 29,200 times 13% \u003d 3,796 rubles. (personal income tax after applying the deduction);

30,000 minus 3,796 = 26,200 rubles. (wage).

In regions where working conditions are considered special, a district coefficient is charged on salaries. Do not confuse it with allowances for End Server employees. The territory of the district coefficient is wider.

The size of such a coefficient is set by the Russian Government for each region and there is no regulation

Each region has its own regulation. The lowest coefficient - 1.15 - in the same Vologda region and in most regions of the Urals.

Such a district coefficient is applied to the actual volume of wages before the deduction of personal income tax. To calculate, you should sum up the salary with allowances and bonuses, with the exception of one-time cash payments (such as material assistance or sick leave), and multiply the total by this coefficient. For example, with an employee's salary of 30,000 and add a bonus of 7,500 rubles, the calculation will be:

(30,000 plus 7,500) multiply by 1.15 = 43,125 rubles. (salary before personal income tax);

43,125 minus 13% = 37,518 rubles (in hand).

An example of a classic payroll calculation

We will calculate wages for August and September. The employee is set a monthly salary of 65,000 rubles.

In August, the employee worked independently for a full month, and from September 9 to 13, he was granted unpaid leave for family reasons.

In this case, the employee's salary for August is 65,000 rubles (65,000 divided by 23), and for September, 56,136 rubles. (65,000 divided by 22 (22-3)).

Salary calculation example

On August 1, Ivanov's salary was 25,000 rubles. In the summer of August 15, he was transferred to a higher and paid specialist position and his salary was increased to 30,000 rubles.

There were 23 working days in August:

from the beginning of the month to August 14, there were 10 slaves. days;

from August 15 to August 31, there were 13 slaves. days.

The accountant calculated the salary for each month of these periods. For the time period from August 1 to August 14 (taking into account the old official salary), the accountant calculated the amount:

25 000 rub. : 23 days for 10 days = 10,869 rubles.

30 000 rub: 23 days for 13 days = 16,956 rubles.

The total salary for August was:

RUB 10,869 plus 16,956 rubles. = 27,826 rubles.

Example #2

An employee works in shifts and is paid by the hour. His salary depends on the number of hours at the workplace and the norm of working hours. Pirogov, the driver of LLC "Master", has a total time record. The accounting period is 1 month, the hourly rate is 180 rubles. The norm for August is 184 hours. However, from 18 to 25 August, the driver took a vacation at his own expense. For this period, based on the work schedule of this employee, there were 48 slaves. hours. So, his norm was 136 hours. That's how much he did.

How is a part-time salary calculated?

Example #3

Mikeshin's salary is 20 thousand rubles. There are 23 business days this month

Then the size of Mikeshin's wages is calculated:

20000 divide by 2319 and subtract 13%*(20000/23*19).

20000+4000=24000 rub. - the amount of payment for one working month.

Let us assume that under the same conditions Mikeshin is entitled to a tax deduction in the amount of 800 rubles. Then:

24,000/23 * 19 = 19,826 rubles - wages for the days he worked without personal income tax.

319826-800=19026 rubles - tax base

19026 * 13% = 2473 rubles - personal income tax

19826-2473 = 17352 rubles - Mikeshin will receive in his arms.

The calculation of wages at any commercial or state enterprise occurs in accordance with the legislative acts in force at a given time. Its amount depends on the official salary prescribed in the employment contract, the hours worked during a certain period and other details. The amount due for payment is calculated by the accountant on the basis of a number of documents.

What is included in the calculation?

To date, two types of payment are most often practiced:

- Time . The first provides for a salary determined by the contract for the hours worked - an hour, a day, a month. Often a monthly rate is practiced. In this case, the total amount depends on the time worked during a certain period of time. It is mainly used in the calculation of salaries for employees who do not depend on the amount of the created product - accountants, teachers, managers.

- piecework . Depends on the amount of product created for a certain period. Often used in factories. It has several subspecies, which we will consider a little later.

Thus, time wages provide that the head of the enterprise or other official is required to maintain and fill out a time sheet. It is issued in the form No. T-13 and is filled out daily.

It should note:

- the number of working hours worked during the day;

- exits "at night" - from 22:00 to 6:00;

- out of hours (weekends, holidays);

- omissions due to various circumstances.

Piecework payment provides for the presence of a route map or an order for a certain amount of work. In addition, the following are taken into account: sick leave, orders for bonuses, orders for the issuance of material assistance.

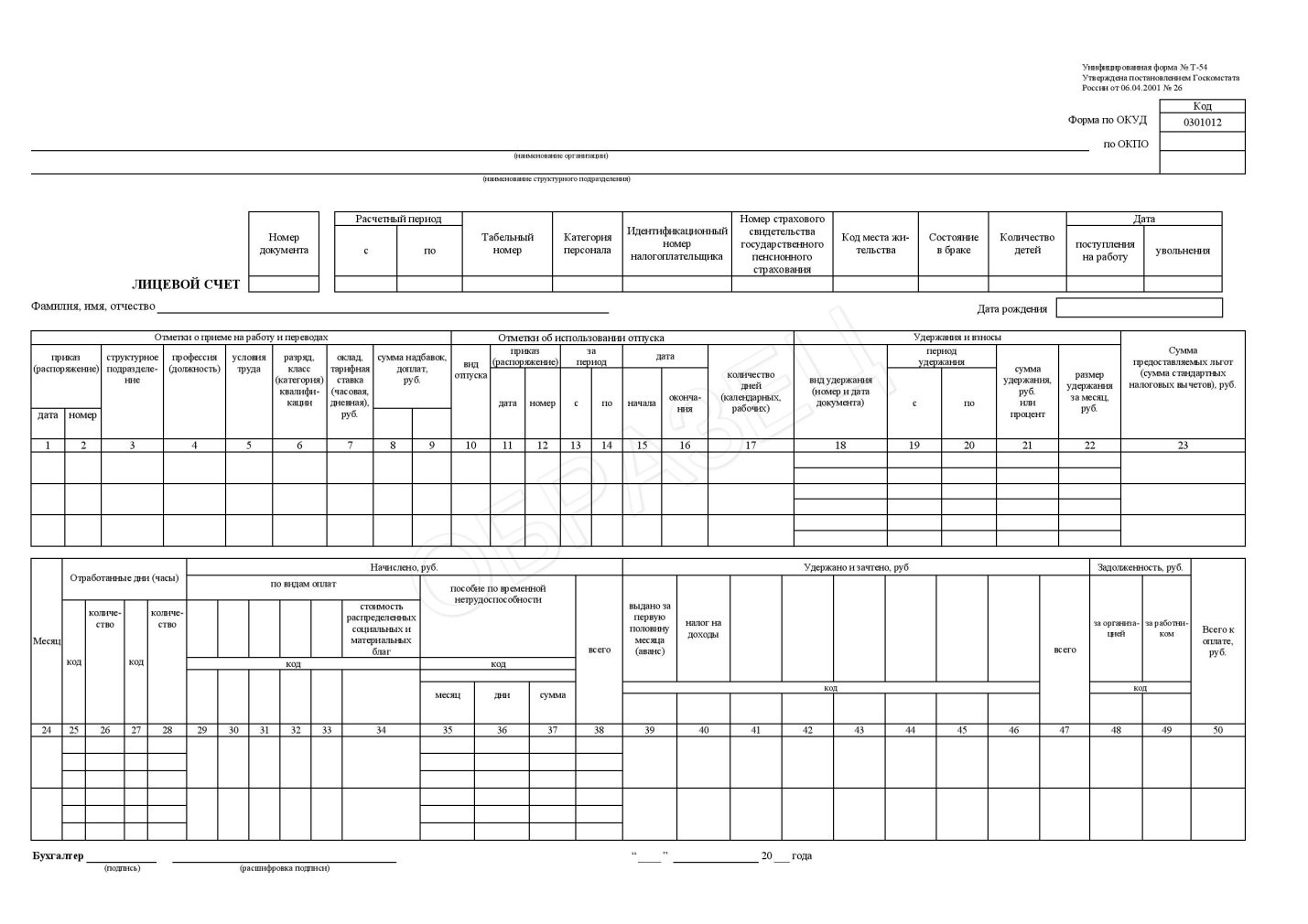

After hiring, each accountant must keep an analytical record of wages and record it in the form No. T-54. This is the so-called personal account of the employee. The data specified in it will be taken into account when calculating hospital payments, vacation and other types of benefits.

You can find out how vacation pay is calculated.

Calculation formula and examples

Hourly pay provides for remuneration according to the time worked and the salary of the employee.

It is calculated as follows:

For monthly salary:

ZP \u003d O * CODE / KD, where

- O - fixed monthly salary;

- CODE - days worked;

- CD is the number of days in a month.

For hourly/daily fixed salary:

ZP \u003d KOV * O, where

- ZP - wages excluding taxes;

- KOV - the amount of hours worked;

- O - salary per unit of time.

Consider an example:

Tatyana Ivanovna has a monthly salary of 15,000 rubles. There were 21 working days in a month, but since she took a vacation at her own expense, she worked only 15 days. In this regard, she will be paid the following amount:

15,000*(15/21)=15,000*0.71= 10,714 rubles 30 kopecks.

Second example:

Oksana Viktorovna works with a daily salary of 670 rubles. This month she worked 19 days. Her salary will be:

670 * 19 \u003d 12,730 rubles.

As you can see, the formula for calculating wages for this type of payment is very simple.

Piecework payment - how to calculate?

With piecework wages, the amount of work performed is paid. At the same time, prices are taken into account in the ratio of the volume of work.

With piecework wages, wages are calculated according to the following formula:

ZP \u003d RI * CT, where

- RI - prices for the manufacture of one unit;

- CT - the number of products produced.

Consider the following example:

Ivan Ivanovich produced 100 engines in a month. The cost of one engine is 256 rubles. Thus, in a month he earned:

100 * 256 \u003d 25,600 rubles.

piece-progressive

It is worth considering separately such a type of payment as piecework-progressive, in which the price depends on the number of products produced for a certain period.

For example, if an employee produces 100 engines per month, then he receives 256 rubles for each. If it exceeds this norm, that is, it produces more than 100 engines per month, the cost of each engine produced in excess of the norm is already 300 rubles.

In this case, earnings for the first 100 engines and separately for subsequent ones are considered separately. The amounts received are cumulative.

For example:

Ivan Ivanovich made 105 engines. His earnings were:

(100*256)+(5*300)=25,600+1,500= 28,100 rubles.

Other payment systems and their calculation

Depending on the specifics of the work, payment can be:

- chord . Often used when paying for the work of the brigade. In this case, the salary of the brigade as a whole is calculated and issued to the foreman. The workers divide the amount received among themselves according to the agreement existing in their brigade.

- Payment based on bonuses or interest . A bonus or commission system is applied to employees on whom the company's revenue depends (see also). Quite often it is applied to sales consultants, managers. There is a constant, fixed rate and a percentage of sales.

- shift work . The shift method of work provides for payment according to the employment contract - that is, by the time or for the amount of work performed. In this case, there may be interest allowances for difficult working conditions. For exits on non-working days, holidays, payment is calculated in the amount of at least one daily or hourly rate on top of the salary. In addition, an allowance is paid for the shift method of work from 30% to 75% of the monthly salary. The interest rate depends on the region in which the work takes place. For example, Ivan Petrovich works on a rotational basis. His monthly rate is 12,000 rubles, the allowance for work in this region is 50% of the salary (O). Thus, his salary will be 12,000 + 50% O \u003d 12,000 + 6,000 \u003d 18,000 rubles per month of work.

Payment for holidays and night shifts

When working in shifts, each shift is paid depending on the tariff rate of each shift. It is either established by an employment contract or calculated by an accountant.

At the same time, it should be borne in mind that weekends and holidays are paid at a higher rate - an increase in the rate by 20%. In addition, exits at night from 22:00 to 06:00 are also subject to a rate increase of 20% of the cost of an hour of work.

payroll taxes

When calculating wages, do not forget about taxes. Thus, the employer is obliged to pay 30% of the amount of calculated wages to the insurance premium fund.

In addition, employees are charged 13% of their wages in personal income tax. Let's take a look at how taxes are calculated.

First of all, the tax is charged on the entire amount of wages, except for cases in which there is a tax deduction. So, a tax deduction is calculated from the total amount of wages, and only then the tax rate is calculated on the resulting value.

The right to a tax deduction has a number of socially unprotected categories, the list of which is prescribed in article 218 of the Tax Code of the Russian Federation. These include:

- Veterans of the Great Patriotic War, invalids, whose activities were connected with nuclear power plants. The tax deduction is 3000 rubles.

- Disabled people, participants of the Second World War, military personnel - 500 rubles.

- Parents who are dependent on one or two children - 1,400 rubles.

- Parents who are dependent on three or more children - 3,000 rubles.

The last two categories are restricted. So, after the amount of wages received from the beginning of the calendar year reaches 280,000 rubles, the tax deduction is not applied until the beginning of the next calendar year.

Example:

Ivan Ivanovich's monthly salary was 14,000 rubles, since he worked for a full month. He received a disability while working at a nuclear power plant. Thus, his tax deduction will be 3,000 rubles.

The personal income tax is calculated for him as follows:

(14,000 - 3,000) * 0.13 = 1430 rubles. This is the amount that must be withheld when receiving wages.

Thus, he will receive in his hands: 14,000 - 1430 \u003d 12,570 rubles.

Second example:

Alla Petrovna is the mother of two minor children. Her salary is 26,000 per month. By December, the total amount of wages paid to her will be 286,000 rubles, therefore, no tax deduction will be applied to her.

Payment procedure and calculation of delays

According to all the same legislation, wages must be paid at least 2 times a month. Allocate an advance, which is issued in the middle of the month and the actual salary.

The advance payment averages from 40 to 50% of the total amount of payments, at the end of the month the rest of the payments are issued. Usually this is the last day of the month, if it falls on a weekend - the last working day of the month. In case of untimely calculation of wages, the employer is obliged to pay a fine.

In addition, compensation is provided for the employee, which is issued at his request and amounts to 1/300 of the rate for each day of delay.

Video: Simple payroll

Familiarize yourself with the basic nuances of calculating and calculating wages. An experienced accountant will tell you how to correctly calculate wages, depending on the wage system you choose.

The calculation of wages is made by an accountant on the basis of a number of documents. There are two main systems of remuneration: piecework and time. The most popular is the time-based wage system - it is quite simple and is used in most industries.